Breaking news on global market performance: what you need to know

Anúncios

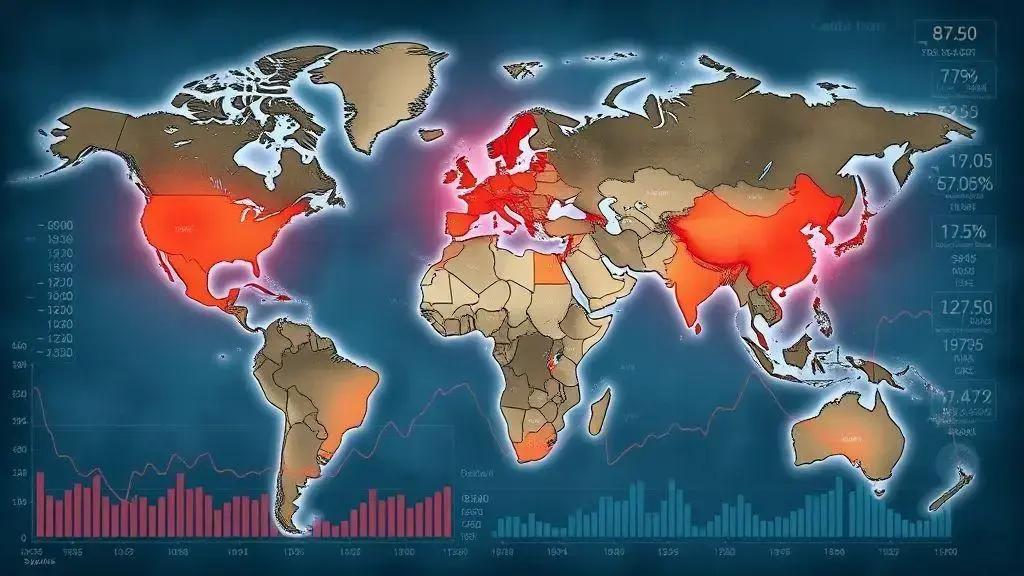

Breaking news on global market performance reveals that key indicators such as GDP, employment rates, and geopolitical events significantly influence market dynamics, highlighting the importance of staying informed for investment decisions.

Breaking news on global market performance is impacting investors and consumers alike. With constant shifts, it’s crucial to stay updated on how these changes affect your portfolio and daily life. Let’s dive into what you need to know.

Anúncios

Current trends in global markets

Understanding the current trends in global markets is vital for anyone interested in finance and investments. With rapid changes occurring every day, staying informed can help you navigate the complexities of investment choices.

Key Influences on Market Trends

Several factors shape global market performance. These include economic indicators, market sentiment, and geopolitical events. Keeping an eye on these influences will help you make more informed decisions.

Anúncios

- Economic indicators: Metrics such as GDP growth, employment rates, and inflation impact market trends.

- Market sentiment: How investors feel about the market can drive prices up or down.

- Geopolitical events: Tensions and agreements between nations can cause fluctuations in market performance.

Another important aspect to consider is how sectors perform differently based on market conditions. For example, technology stocks may thrive during economic expansion, while consumer staples might do well in a downturn. By analyzing different sectors, you can determine where opportunities may arise.

Sector Performance Analysis

Investors should also pay attention to emerging trends within specific sectors. For instance, renewable energy has gained significant traction due to an increased focus on sustainability. This shift can lead to new investment opportunities.

- Technology: Continuous innovation drives growth.

- Healthcare: Aging populations create demand.

- Energy: Shifts towards renewables can reshape investments.

Moreover, understanding consumer behavior can provide insights into how markets may react to changes. As people adapt to new lifestyles and technologies, their spending habits shift, which can significantly impact market dynamics. For example, e-commerce has surged, especially after the pandemic, reshaping traditional retail landscapes.

In conclusion, staying updated with the current trends in global markets allows investors to make informed decisions. By analyzing various factors and understanding the interplay between them, one can navigate the complexities of global investing effectively. The qualitative and quantitative insights gained from these trends are invaluable for any investor.

Key indicators affecting performance

Identifying the key indicators affecting performance in global markets is essential for grasping how economies operate. These indicators provide insights into trends that influence business and investment decisions.

Economic Growth and GDP

The Gross Domestic Product (GDP) is one of the most significant indicators of economic health. A rising GDP generally signals a growing economy, encouraging investment. Conversely, a declining GDP can lead to reduced consumer confidence and spending.

- GDP growth rate: A high growth rate often leads to bullish market sentiment.

- GDP per capita: Indicates the economic output per person, reflecting individual prosperity.

- Real GDP: Adjusted for inflation, providing a clearer picture of growth.

Another critical factor is the unemployment rate. A low unemployment rate usually means more people have jobs, boosting consumer spending. Conversely, high unemployment can signal economic distress, reducing market confidence.

Inflation and Interest Rates

Inflation directly influences consumer prices and purchasing power. When inflation rises, the cost of goods increases, potentially leading to lower consumption. Central banks often react by adjusting interest rates to manage inflation. For example, higher interest rates can dampen spending and borrowing.

- Consumer Price Index (CPI): Measures price changes in a basket of consumer goods and services.

- Producer Price Index (PPI): Reflects price changes from the perspective of the seller.

- Core inflation: Excludes volatile items like food and energy for a clearer view.

In conclusion, monitoring these key indicators affecting performance helps investors make informed decisions. Keeping track of these metrics enables individuals and businesses to navigate the ever-changing landscape of global markets effectively.

How geopolitical events shape market dynamics

Geopolitical events can significantly influence financial markets. These events, which range from political conflicts to trade agreements, often create uncertainty and volatility. Understanding how these situations play out can help investors make better decisions.

Impact of Political Conflicts

Political conflicts, such as wars or governmental changes, can disrupt markets rapidly. These scenarios usually lead to increased risk aversion among investors. When tensions rise, investors often flee to safer assets, like gold or government bonds, moving away from stocks.

- Stock market reactions: Political instability tends to drive stock prices down.

- Safe-haven assets: Investors seek security, favoring gold and U.S. Treasuries.

- Sector performance: Defense and energy sectors may benefit from increased governmental spending.

Additionally, trade agreements and tariffs between nations can alter market dynamics. For instance, when countries enter new trade partnerships, it can stimulate economic growth and positively impact market conditions. On the other hand, tariffs can lead to increased costs for consumers and strain relationships between trading partners.

Economic Sanctions

Economic sanctions are another tool that governments use to influence foreign policy. These sanctions can have far-reaching effects on global markets by affecting supply chains and commodity prices. For example, sanctions against oil-producing nations can lead to spikes in oil prices, impacting transportation and manufacturing costs worldwide.

- Supply chain disruption: Sanctions may cause delays and increased costs for businesses reliant on foreign imports.

- Commodity price fluctuations: Prices for goods such as oil and metals can rise or fall, affecting various industries.

- Market sentiment: Investor confidence may decline due to uncertainty surrounding sanctions.

Finally, global events like climate change discussions and environmental agreements can also shape market dynamics. These discussions often lead to investment in sustainable technologies and initiatives aimed at reducing carbon footprints.

In summary, understanding how geopolitical events shape market dynamics is vital for investors. Keeping track of political developments, trade negotiations, and environmental policies can provide valuable insights into potential market movements.

Sector analysis: winners and losers

In the world of finance, a sector analysis helps identify which industries are thriving and which are struggling. Different events and trends impact each sector in unique ways, influencing investment decisions.

Technological Advancements

The technology sector has been a clear winner in recent years. Innovations in artificial intelligence, cloud computing, and e-commerce have driven growth. Companies that adapt quickly to changing technology often outperform their competitors.

- Cloud computing: Businesses are shifting to cloud solutions for increased efficiency.

- Artificial intelligence: AI applications are transforming industries from healthcare to finance.

- E-commerce growth: Online retail continues to expand, especially post-pandemic.

On the other hand, traditional retail has faced significant challenges. Many brick-and-mortar stores struggle to compete with online giants. Shifts in consumer behavior have led to a decrease in foot traffic, affecting sales and profitability.

Energy Sector Performance

The energy sector presents a mixed picture. Renewable energy companies are on the rise, benefiting from the global push for sustainability. Meanwhile, traditional fossil fuel companies have faced scrutiny and fluctuating prices due to climate change discussions and regulations.

- Renewable energy: Solar and wind power investments are increasing.

- Oil prices: Volatility impacts traditional energy companies.

- Government policies: Environmental regulations can shift market dynamics.

Healthcare is another sector worth analyzing. The industry has seen growth due to an aging population and increased demand for medical services. Biotech and pharmaceuticals are leading the way with innovative treatments and vaccines. However, shifts in policy and regulations can pose risks.

In summary, conducting a sector analysis reveals both winners and losers across various industries. Keeping track of these trends helps investors adapt their strategies to market conditions, maximizing opportunities while minimizing risks.

Future predictions for global economic stability

Future predictions for global economic stability involve analyzing various trends and indicators that can shape the economy. As global markets continue to evolve, understanding potential outcomes is essential for investors and businesses alike.

Emerging Markets

Many analysts believe that emerging markets will play a significant role in future economic growth. Countries in Asia, Africa, and South America are expected to see increased investment opportunities. These markets are often more resilient due to their growing consumer bases and resource richness.

- Population growth: A young demographic can drive consumption and innovation.

- Technological adoption: Rapid tech integration can enhance productivity.

- Resource availability: Natural resources can fuel economic expansion.

On the other hand, developed economies may face challenges ahead. Issues such as aging populations and high debt levels can hamper growth. These challenges may lead to slower economic expansion in regions like Europe and North America.

Technological Advancements

Technology is likely to continue transforming the global economy. Automation, artificial intelligence, and renewable energy sources have the potential to reshape industries. For instance, businesses that invest in sustainable practices may find themselves ahead of the curve.

- AI and automation: Efficiency improvements can drive profits.

- Green technologies: A focus on sustainability can create new markets.

- Remote work: Changing workforce dynamics can influence urban development.

Geopolitical tensions will also play a crucial role in shaping future predictions. Trade wars, tariffs, and international relations can impact investor confidence and market stability. Countries that adapt to these changes may better navigate potential economic pitfalls.

Overall, the future of global economic stability relies on a mix of emerging market dynamics, technological progress, and geopolitical realities. Investors who keep a pulse on these factors are better positioned to thrive in changing landscapes.

FAQ – Frequently Asked Questions on Global Market Performance

What are the key indicators of global market performance?

Key indicators include GDP growth, inflation rates, employment figures, and consumer spending, which help assess economic health.

How do geopolitical events impact financial markets?

Geopolitical events can create uncertainty, affecting investor confidence and causing fluctuations in stock prices.

Which sectors are currently performing well in the market?

Technology and renewable energy sectors are performing well, while traditional retail and fossil fuel industries face challenges.

What should investors consider for future predictions?

Investors should consider emerging markets, technological advancements, and geopolitical trends to make informed predictions about the economy.