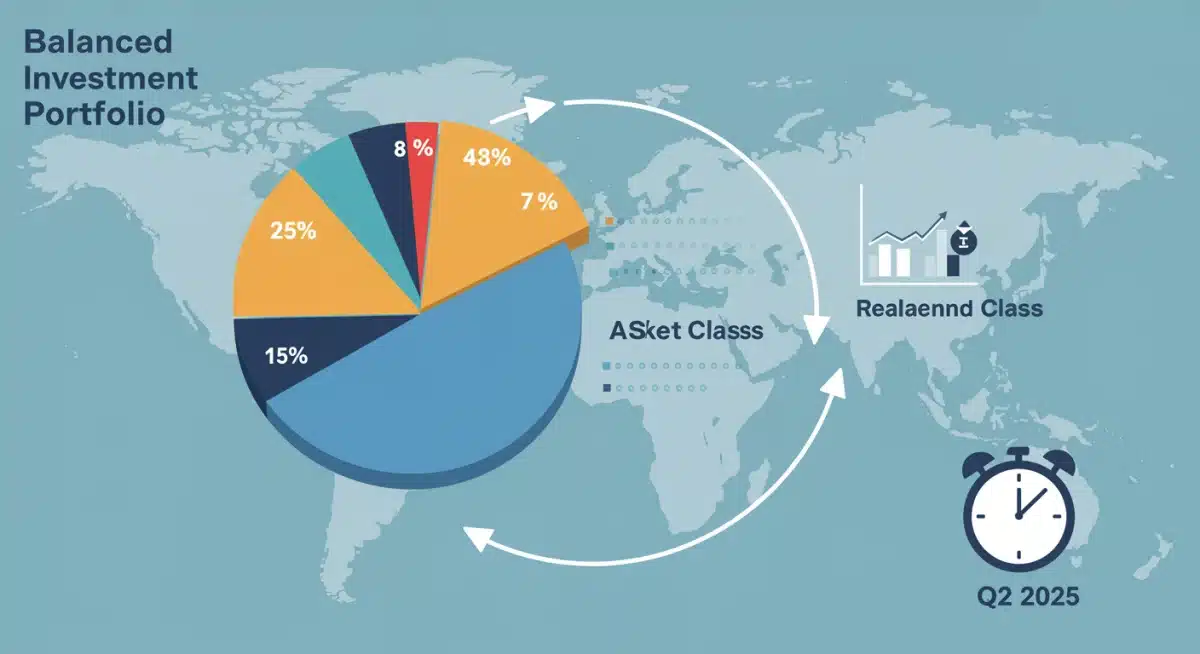

Strategic Portfolio Rebalancing Q2 2025: Market Volatility Adjustments

Anúncios

Strategic portfolio rebalancing for Q2 2025 is essential for navigating market volatility, involving three key adjustments to maintain alignment with financial goals and risk tolerance amid evolving economic landscapes.

Anúncios

As we approach the second quarter of 2025, investors face an ever-evolving financial landscape characterized by persistent volatility and shifting economic indicators. The need for a proactive approach to investment management has never been more critical. This article delves into the crucial process of strategic portfolio rebalancing for Q2 2025: adapting to current market volatility with 3 key adjustments, offering insights to help investors optimize their portfolios for resilience and potential growth. Understanding the dynamics of rebalancing is not just about reacting to market shifts, but about deliberately positioning your assets to align with your long-term objectives and risk appetite. The coming quarter demands a thoughtful, data-driven strategy to navigate potential headwinds and capitalize on emerging opportunities, ensuring your financial plan remains robust against unforeseen market movements.

Understanding the Q2 2025 Market Landscape

The financial markets entering Q2 2025 are shaped by a confluence of macroeconomic factors, technological advancements, and geopolitical developments. Interest rate policies, inflation trends, and global supply chain stability continue to exert significant influence on asset valuations. Investors are keenly observing central bank communications for clues on future monetary policy, which directly impacts everything from bond yields to equity performance. Moreover, the pace of technological innovation, particularly in areas like artificial intelligence and sustainable energy, is creating new investment opportunities while simultaneously disrupting traditional sectors.

Anúncios

Geopolitical tensions, while often unpredictable, also contribute to market volatility, necessitating a flexible and adaptive investment strategy. These factors collectively create an environment where a ‘set it and forget it’ approach to investing is increasingly perilous. Instead, a dynamic approach that incorporates regular evaluations and strategic adjustments is paramount. Understanding these overarching trends forms the foundational step in any effective portfolio management strategy for the upcoming quarter.

Key Economic Indicators to Monitor

To effectively rebalance a portfolio, investors must stay informed about several critical economic indicators. These metrics provide a snapshot of the broader economic health and can signal potential shifts in market sentiment and asset performance. Closely tracking these indicators allows for more informed decision-making.

- Inflation Rates: Persistent inflation can erode purchasing power and impact corporate earnings, influencing asset allocation decisions.

- Interest Rate Decisions: Central bank rate hikes or cuts directly affect borrowing costs, bond yields, and the attractiveness of different asset classes.

- GDP Growth: Strong GDP growth often correlates with robust corporate profits and a bullish stock market, while slowdowns can signal caution.

- Employment Data: Low unemployment and wage growth indicate a healthy economy, supporting consumer spending and business expansion.

Monitoring these indicators provides a framework for anticipating market movements, allowing investors to adjust their portfolios preemptively rather than reactively. This proactive stance is a hallmark of successful strategic portfolio rebalancing.

Technological Shifts and Their Investment Implications

The rapid evolution of technology continues to reshape industries and create new investment frontiers. Emerging technologies like AI, blockchain, and biotechnology are not just buzzwords; they represent fundamental shifts in how businesses operate and generate value. Investors must consider how these advancements might impact their holdings and where new opportunities are arising.

For example, the widespread adoption of AI could boost the tech sector, while also benefiting companies that leverage AI for efficiency gains across other industries. Conversely, businesses failing to adapt to these technological shifts might face headwinds. Integrating an understanding of these trends into your rebalancing strategy ensures your portfolio remains relevant and positioned for future growth. The long-term implications of these technological shifts cannot be overstated, making them a critical component of any forward-looking investment analysis.

The Q2 2025 market environment demands a vigilant and informed approach. By understanding the prevailing economic conditions, monitoring key indicators, and recognizing the impact of technological shifts, investors can lay the groundwork for effective strategic portfolio rebalancing. This comprehensive awareness is the bedrock upon which sound investment decisions are built, allowing for targeted adjustments that align with the dynamic nature of global finance.

Adjustment 1: Re-evaluating Equity Exposure and Sector Allocation

The first crucial adjustment for Q2 2025 strategic portfolio rebalancing involves a thorough re-evaluation of your equity exposure and sector allocation. Market volatility often means that certain sectors outperform while others lag, leading to unintended concentrations or dilutions within your portfolio. A systematic review ensures your equity holdings still align with your risk tolerance and growth objectives. This isn’t merely about selling underperforming assets; it’s about making informed decisions based on forward-looking analysis of sector potential and macroeconomic trends. The goal is to optimize for both defensive strength and opportunistic growth.

Assessing Overweight and Underweight Sectors

Begin by identifying which sectors in your current portfolio have become overweight or underweight relative to your target allocation. This deviation can occur naturally as markets fluctuate. For instance, if technology stocks have had a strong run, they might now constitute a larger portion of your portfolio than initially intended. Conversely, sectors like financials or industrials might have underperformed, leaving them underweight. Addressing these imbalances is key to maintaining a diversified and robust portfolio.

- Technology: Evaluate if current valuations are sustainable or if a correction is likely, considering innovation vs. market sentiment.

- Healthcare: Assess resilience during economic downturns and growth potential from demographic shifts and new medical advancements.

- Energy: Consider the impact of global supply and demand dynamics, geopolitical factors, and the transition to renewable sources.

- Consumer Staples: Often seen as defensive, gauge their stability against inflation and evolving consumer preferences.

This assessment should not be purely backward-looking. Instead, it requires an analysis of future growth prospects, potential risks, and the overall economic cycle’s impact on each sector. An objective view of these positions is essential for making unbiased rebalancing decisions.

Diversifying Across Market Capitalizations

Beyond sector allocation, it’s vital to ensure diversification across different market capitalizations. Large-cap stocks often offer stability, while mid-cap and small-cap stocks can provide higher growth potential, albeit with increased volatility. A balanced approach typically involves exposure to all three, reflecting a blend of stability and growth. Market conditions in Q2 2025 might favor one market cap segment over another, making it a critical consideration during rebalancing.

Small-cap companies, for example, can be more susceptible to economic downturns but may experience significant rallies during recovery periods. Large-cap companies, on the other hand, often have stronger balance sheets and global footprints, providing a buffer against localized economic shocks. Adjusting your exposure to these different segments can help manage overall portfolio risk and enhance return potential. The aim is to create a well-rounded equity component that can weather various market conditions.

Re-evaluating equity exposure and sector allocation is a dynamic process that requires continuous attention to market trends and economic data. By systematically assessing sector performance, adjusting for overweight/underweight positions, and ensuring diversification across market capitalizations, investors can optimize their equity holdings. This proactive adjustment ensures the portfolio remains aligned with strategic objectives and is well-positioned to adapt to the ongoing volatility expected in Q2 2025.

Adjustment 2: Optimizing Fixed Income and Alternative Investments

The second key adjustment for strategic portfolio rebalancing in Q2 2025 focuses on optimizing fixed income and alternative investments. In a volatile market, these asset classes play a crucial role in providing stability, diversification, and potentially inflation protection. Fixed income, traditionally seen as a ballast, requires careful consideration of interest rate environments and credit risk. Alternative investments, ranging from real estate to commodities, offer unique return streams and can reduce correlation with traditional equity markets, enhancing overall portfolio resilience.

The current economic climate, characterized by fluctuating inflation and interest rate expectations, makes a nuanced approach to these asset classes particularly important. Investors should assess how their current fixed income and alternative holdings are positioned to perform under various economic scenarios, ensuring they contribute effectively to risk management and long-term financial goals.

Navigating Fixed Income in a Changing Rate Environment

Fixed income investments, such as bonds, are highly sensitive to interest rate changes. As central banks adjust monetary policy, the value and attractiveness of different types of bonds can shift dramatically. In an environment where interest rates might continue to fluctuate, duration management becomes critical. Short-duration bonds tend to be less sensitive to rate hikes, while longer-duration bonds offer higher yields but carry more interest rate risk.

- Short-Duration Bonds: Ideal for mitigating interest rate risk in a rising rate environment, offering liquidity.

- Inflation-Protected Securities (TIPS): Provide a hedge against inflation, as their principal value adjusts with the Consumer Price Index.

- High-Yield Bonds: Offer higher returns but come with increased credit risk, requiring careful assessment of issuer solvency.

- Diversified Bond Funds: Can provide broad exposure and professional management, spreading risk across various bond types.

Rebalancing the fixed income portion of your portfolio means adjusting the mix of bond types, maturities, and credit qualities to align with your outlook on interest rates and inflation. This ensures that your fixed income allocation continues to provide the desired level of income and capital preservation without exposing the portfolio to undue risk.

Integrating Alternative Investments for Diversification

Alternative investments can be powerful tools for enhancing diversification and potentially boosting returns, especially during periods of market volatility. Unlike traditional stocks and bonds, alternatives often have low correlation with conventional asset classes, meaning they may perform differently when equities or bonds are struggling. This makes them valuable for smoothing out portfolio returns.

Consider assets such as real estate, commodities, private equity, or hedge funds. Each offers distinct risk-return characteristics and can serve different purposes within a diversified portfolio. For instance, real estate can provide inflation protection and income, while commodities might hedge against rising raw material costs. Private equity can offer access to high-growth companies not available on public markets. However, alternatives often come with lower liquidity and higher fees, necessitating careful due diligence.

Optimizing fixed income and alternative investments is about strategically positioning these assets to complement your equity holdings. By carefully managing duration in fixed income and selectively integrating alternatives, investors can build a more robust and diversified portfolio. This adjustment is vital for mitigating risk and enhancing the portfolio’s capacity to generate stable returns, even amidst the unpredictable market conditions of Q2 2025.

Adjustment 3: Refining Risk Management and Liquidity Strategy

The third crucial adjustment for strategic portfolio rebalancing in Q2 2025 is refining your risk management and liquidity strategy. Market volatility inherently brings increased uncertainty, making a well-defined approach to managing risk and ensuring adequate liquidity paramount. This involves not only assessing your overall risk tolerance but also implementing specific measures to protect against downside risks and maintain flexibility. A robust risk management framework helps prevent emotional decisions during market downturns, while a sound liquidity strategy ensures you can meet financial obligations without being forced to sell assets at unfavorable times.

This adjustment is less about specific asset allocation and more about the overarching framework that guides your investment decisions. It’s about building a portfolio that can withstand shocks and adapt to changing personal circumstances, ensuring long-term financial security regardless of market gyrations.

Assessing and Adjusting Risk Tolerance

Your risk tolerance is not static; it can evolve with life changes, market experiences, and personal financial goals. Before making any rebalancing decisions, it’s essential to reassess your current risk tolerance. Are you comfortable with the potential for larger drawdowns in pursuit of higher returns, or do you prioritize capital preservation? Market volatility can test even the most steadfast investors, making it a good time to honestly evaluate your comfort level with risk.

- Financial Goals: Align your risk tolerance with the time horizon and importance of your financial objectives.

- Emotional Comfort: Understand your psychological response to market fluctuations and potential losses.

- Capacity for Loss: Objectively determine how much capital you can afford to lose without jeopardizing your financial well-being.

- Investment Horizon: Longer horizons generally allow for greater risk-taking, as there’s more time to recover from downturns.

If your risk tolerance has shifted, your portfolio’s asset allocation should reflect this. This might mean reducing exposure to highly volatile assets or increasing allocations to more conservative investments. A mismatch between your actual risk tolerance and your portfolio’s risk profile can lead to poor decision-making during stressful market periods.

Building a Robust Liquidity Buffer

Liquidity refers to the ease with which an investment can be converted into cash without significantly affecting its price. In a volatile market, having adequate liquidity is crucial. It provides a safety net, allowing you to cover unexpected expenses or seize investment opportunities without being forced to sell long-term assets at a loss. A robust liquidity strategy typically involves maintaining a cash reserve or highly liquid short-term investments.

This buffer should ideally cover several months of living expenses, separate from your investment portfolio. Additionally, consider the liquidity of your investment holdings. While some alternative investments offer attractive returns, they often come with lower liquidity. Balancing these less liquid assets with highly liquid ones is key to maintaining financial flexibility. Without sufficient liquidity, even a well-diversified portfolio can face challenges during periods of market stress.

Refining risk management and liquidity strategy is an ongoing process that safeguards your financial well-being. By regularly assessing your risk tolerance and ensuring a robust liquidity buffer, you equip your portfolio to navigate unpredictable market conditions. This adjustment provides the foundational strength necessary for long-term investment success, allowing you to remain disciplined and strategic even in the face of Q2 2025 market volatility.

Implementing Your Rebalancing Strategy

Once you’ve identified the necessary adjustments, the next step is to implement your rebalancing strategy effectively. This involves a systematic approach to executing trades, minimizing costs, and maintaining a disciplined mindset. Rebalancing should not be an impulsive reaction to daily market movements, but rather a deliberate action based on your predefined rules and financial objectives. A well-executed strategy ensures that your portfolio moves closer to its target asset allocation, optimizing for your desired risk-return profile.

Remember that the goal of rebalancing is to manage risk and maintain alignment with your long-term plan, not to chase market trends. Consistency and adherence to your strategy are far more important than attempting to perfectly time the market.

Setting Rebalancing Triggers and Intervals

To avoid emotional decision-making, it’s wise to establish clear rebalancing triggers. These can be time-based, such as rebalancing quarterly or semi-annually, or target-based, where you rebalance when an asset class deviates by a certain percentage from its target allocation. For Q2 2025, a quarterly review might be appropriate given the current market volatility.

- Time-Based Rebalancing: Schedule reviews and adjustments at regular intervals (e.g., end of each quarter), providing a consistent approach.

- Threshold-Based Rebalancing: Act when an asset class deviates by a predefined percentage (e.g., 5% or 10%) from its target weight.

- Combination Approach: Utilize both time-based reviews and threshold triggers, offering flexibility and responsiveness.

- Market Event-Driven: Consider rebalancing after significant market events that drastically alter asset valuations.

Choosing the right trigger mechanism depends on your personal preferences, the level of market volatility, and the types of assets in your portfolio. The key is to have a consistent approach that you can stick to, preventing ad-hoc decisions driven by short-term market noise.

Minimizing Transaction Costs and Tax Implications

Rebalancing involves buying and selling assets, which can incur transaction costs and potentially generate taxable events. It’s important to be mindful of these factors to maximize your net returns. Consider using tax-efficient strategies, such as selling assets in tax-advantaged accounts first, or using capital losses to offset capital gains.

For example, if you need to reduce your exposure to an overweight asset, consider selling shares that have a loss first to generate a tax deduction. Conversely, if you’re selling assets with significant gains, evaluate the tax implications, especially if they are held in taxable accounts. Working with a financial advisor can help you navigate these complexities and implement a rebalancing strategy that is both effective and tax-efficient. Minimizing these costs can significantly impact your long-term investment performance.

Implementing your rebalancing strategy requires discipline, clear rules, and an awareness of costs. By setting appropriate triggers, managing transaction expenses, and considering tax implications, you can execute your adjustments efficiently. This structured approach ensures that your portfolio remains optimally aligned with your financial goals and risk tolerance, ready to navigate the challenges and opportunities of Q2 2025 with confidence.

The Psychology of Rebalancing in Volatile Markets

Rebalancing a portfolio, especially during periods of market volatility, often requires overcoming psychological biases. Human emotions, such as fear and greed, can significantly impact investment decisions, leading to suboptimal outcomes. When markets are surging, there’s a temptation to let winning assets run indefinitely, even if they’ve become overconcentrated. Conversely, during downturns, fear can trigger panic selling, locking in losses and preventing recovery. Understanding these psychological pitfalls is as crucial as understanding market fundamentals itself.

A disciplined rebalancing strategy acts as a counterweight to these emotional impulses. It enforces a systematic approach, ensuring that decisions are based on predefined rules rather than reactive emotions. This detachment from immediate market noise is essential for long-term investment success, particularly in the unpredictable environment of Q2 2025.

Overcoming Emotional Biases

Emotional biases are inherent in human decision-making and can be particularly potent in financial markets. Recognizing these biases is the first step toward mitigating their impact. For instance, ‘herding’ behavior, where investors follow the crowd, can lead to buying at market peaks and selling at troughs. ‘Anchoring,’ where investors fixate on past prices, can prevent them from making objective decisions about current valuations.

- Confirmation Bias: Tendency to seek out information that confirms existing beliefs and ignore contradictory evidence.

- Loss Aversion: The psychological tendency to prefer avoiding losses over acquiring equivalent gains.

- Availability Heuristic: Overestimating the likelihood of events based on their vividness or recency in memory.

- Overconfidence: An exaggerated belief in one’s own ability to predict market movements or pick winning stocks.

By understanding these biases, investors can develop strategies to counteract them. Sticking to a predefined rebalancing plan, for example, helps to depersonalize investment decisions, making them more rational and less emotionally charged. This discipline is a cornerstone of effective portfolio management.

Maintaining Discipline Through Market Cycles

Discipline is arguably the most important attribute for successful investing, especially when rebalancing in volatile markets. It means adhering to your long-term investment strategy even when short-term market fluctuations tempt you to deviate. Rebalancing often requires selling assets that have performed well and buying those that have underperformed – a counter-intuitive action for many investors.

However, this ‘buy low, sell high’ approach is fundamental to maintaining your target asset allocation and capitalizing on market cycles. During a market downturn, buying more of an underperforming asset class can feel uncomfortable, but it’s precisely when those assets may offer the best long-term value. Conversely, trimming a high-flying asset class prevents overconcentration and reduces risk. By consistently applying your rebalancing rules, you ensure your portfolio remains aligned with your risk profile and long-term goals, regardless of the emotional rollercoaster of market cycles.

The psychology of rebalancing highlights the importance of a disciplined, rules-based approach to investing. By acknowledging and actively working to overcome emotional biases, investors can make more rational decisions. Maintaining this discipline through various market cycles is crucial for successful strategic portfolio rebalancing, allowing you to navigate the complexities of Q2 2025 with greater confidence and achieve your financial objectives.

Long-Term Benefits of Consistent Rebalancing

While the immediate goal of strategic portfolio rebalancing for Q2 2025 is to adapt to current market volatility, the practice also yields significant long-term benefits. Consistent rebalancing is not just a tactical maneuver; it’s a fundamental component of sound investment management that contributes to sustained growth, risk control, and adherence to financial plans over extended periods. It helps investors stay on track towards their goals by preventing asset allocations from drifting too far from their intended targets, thereby mitigating unintended risks and capitalizing on market movements systematically.

The cumulative effect of regular rebalancing can be substantial, offering a more stable and potentially more rewarding investment journey than a passive ‘buy and hold’ strategy without periodic adjustments. It reinforces the principle of ‘buying low and selling high’ through a structured process, rather than speculative timing.

Mitigating Portfolio Drift and Risk

One of the primary long-term benefits of consistent rebalancing is the mitigation of portfolio drift. Over time, different asset classes will perform differently, causing your portfolio’s allocation to diverge from your initial target. For example, a strong bull market in equities might cause your stock allocation to grow significantly beyond its intended percentage, increasing your overall portfolio risk without your explicit intention. Conversely, a prolonged bear market could leave you with too little equity exposure, hindering long-term growth.

Rebalancing systematically brings your portfolio back to its target allocation, ensuring that your risk exposure remains consistent with your comfort level and financial goals. This proactive management prevents your portfolio from becoming unintentionally concentrated in risky assets or too conservative to meet your growth objectives. By regularly adjusting, you maintain a balanced risk profile that is appropriate for your investment horizon and capacity for loss.

Enhancing Long-Term Return Potential

Beyond risk management, consistent rebalancing can also enhance long-term return potential. By periodically selling assets that have outperformed (and are therefore likely overvalued) and buying assets that have underperformed (and may be undervalued), rebalancing naturally encourages a ‘contrarian’ approach. This disciplined buying of relatively cheaper assets and selling of relatively more expensive ones can lead to higher risk-adjusted returns over time.

It helps to capture gains from strong-performing assets while reinvesting in those that have room for recovery or future growth. This systematic approach eliminates the need for market timing, a notoriously difficult and often unsuccessful endeavor. Instead, it relies on the principle that asset classes tend to revert to their mean performance over the long run, allowing investors to capitalize on these cycles through regular adjustments. The power of compounding these rebalancing benefits can be a significant boost to your overall wealth accumulation.

Consistent strategic portfolio rebalancing is a cornerstone of effective long-term investment management. By actively mitigating portfolio drift, controlling risk, and systematically enhancing return potential, investors can build a more resilient and growth-oriented portfolio. This discipline, especially when navigating volatile periods like Q2 2025, ensures that your investment strategy remains aligned with your financial aspirations, fostering greater confidence and success over your investment journey.

| Key Adjustment | Brief Description |

|---|---|

| Equity & Sector Re-evaluation | Adjusting stock exposure and sector allocation to align with Q2 2025 market trends and risk tolerance. |

| Fixed Income & Alternatives Optimization | Fine-tuning bond duration and integrating alternatives for diversification and stability. |

| Risk & Liquidity Strategy | Reassessing risk tolerance and building robust liquidity buffers to navigate volatility. |

Frequently Asked Questions About Portfolio Rebalancing

Portfolio rebalancing is crucial in Q2 2025 due to persistent market volatility and evolving economic conditions. It ensures your investment allocation remains aligned with your risk tolerance and financial goals, preventing unintended concentrations and optimizing for potential growth amid shifting market dynamics. It’s a proactive measure against market drift.

The frequency of rebalancing depends on individual preferences and market conditions. Common approaches include time-based rebalancing (e.g., quarterly or annually) or threshold-based rebalancing (when an asset class deviates by a certain percentage from its target). Given Q2 2025’s volatility, a quarterly review might be beneficial.

Not rebalancing can lead to portfolio drift, where your asset allocation deviates significantly from your target. This can expose you to unintended risks, such as overconcentration in volatile assets, or hinder long-term growth by having too little exposure to growth-oriented assets. It also misses opportunities to “buy low and sell high” systematically.

Yes, alternative investments can offer valuable diversification and potentially enhance returns, especially in volatile markets. Assets like real estate, commodities, or private equity often have low correlation with traditional stocks and bonds, providing stability. However, they typically come with lower liquidity and higher fees, requiring careful consideration.

Rebalancing can trigger capital gains or losses, impacting your tax liability. It’s important to consider tax-efficient strategies, such as rebalancing within tax-advantaged accounts first, or using capital losses to offset gains. Consulting a financial advisor can help minimize the tax implications of your rebalancing strategy.

Conclusion

Navigating the complex and often unpredictable financial markets of Q2 2025 demands a proactive and disciplined approach to investment management. Strategic portfolio rebalancing, characterized by the three key adjustments discussed—re-evaluating equity exposure, optimizing fixed income and alternative investments, and refining risk management and liquidity—is not merely an option but a necessity. By consistently aligning your portfolio with your financial goals and risk tolerance, you can mitigate the impact of market volatility, capitalize on emerging opportunities, and ensure the long-term resilience and growth of your investments. The commitment to regular review and adjustment, coupled with an understanding of market psychology, ultimately empowers investors to remain steadfast and strategic, building a robust financial future in an ever-changing economic landscape.